All Categories

Featured

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

[/image][=video]

[/video]

Withdrawals from the cash value of an IUL are usually tax-free up to the quantity of costs paid. Any withdrawals over this amount might be subject to tax obligations depending on plan framework.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for at the very least 5 years and the person mores than 59. Properties taken out from a traditional or Roth 401(k) prior to age 59 may incur a 10% penalty. Not exactly The cases that IULs can be your own bank are an oversimplification and can be misinforming for numerous factors.

Nevertheless, you might go through upgrading associated health questions that can affect your continuous costs. With a 401(k), the cash is constantly yours, consisting of vested employer matching no matter whether you stop contributing. Threat and Guarantees: First and leading, IUL plans, and the money value, are not FDIC insured like basic savings account.

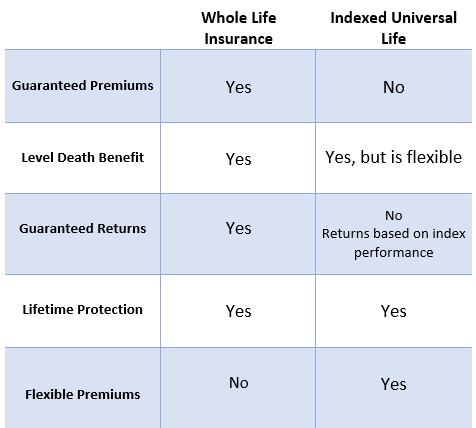

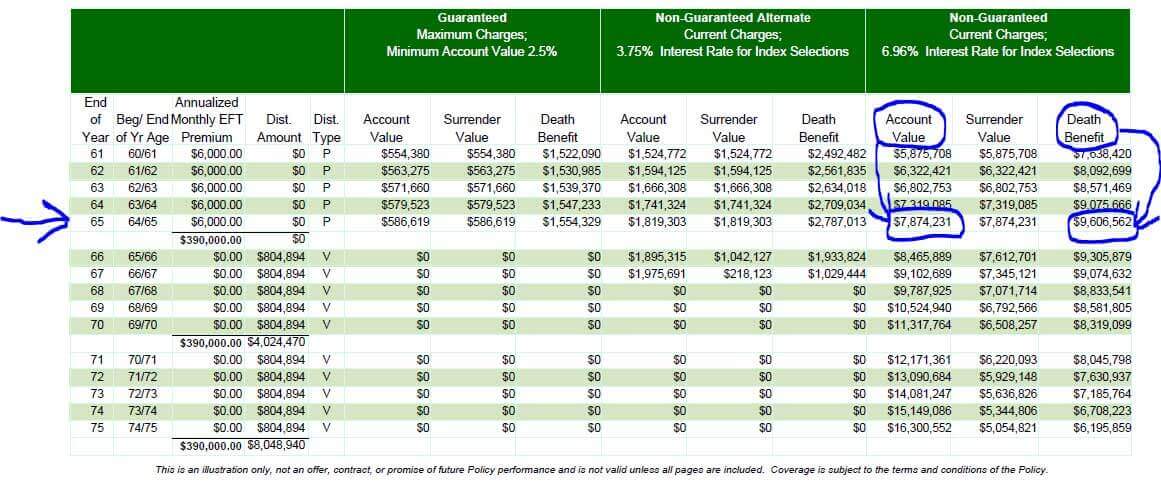

While there is usually a flooring to avoid losses, the growth capacity is covered (suggesting you might not completely take advantage of market upswings). The majority of specialists will concur that these are not similar products. If you desire death benefits for your survivor and are worried your retired life financial savings will certainly not be sufficient, then you might want to consider an IUL or various other life insurance policy item.

Sure, the IUL can provide access to a money account, however again this is not the key purpose of the product. Whether you desire or require an IUL is a highly individual question and relies on your key economic goal and objectives. Nonetheless, listed below we will certainly try to cover advantages and constraints for an IUL and a 401(k), so you can further mark these products and make a more educated decision relating to the most effective way to handle retired life and dealing with your loved ones after death.

Best Iul For Cash Accumulation

Loan Prices: Financings against the policy build up interest and, otherwise paid back, minimize the death advantage that is paid to the recipient. Market Involvement Limits: For most plans, financial investment development is linked to a stock exchange index, however gains are generally covered, restricting upside potential - transamerica iul review. Sales Practices: These policies are often marketed by insurance policy agents who may emphasize benefits without totally discussing expenses and dangers

While some social media sites experts recommend an IUL is a substitute item for a 401(k), it is not. These are different items with different goals, features, and prices. Indexed Universal Life (IUL) is a type of irreversible life insurance policy policy that also uses a money value component. The cash value can be made use of for several objectives consisting of retirement cost savings, additional income, and other monetary demands.

Latest Posts

Iul Tax Free Retirement

What Is A Roth Iul

Nationwide Iul Accumulator Quick Quote